By Mustafa Shah-Khan, DDS

To be a successful CFO of your practice, it’s imperative to understand how the prices you are paying for supplies are set. In this article, Dr. Shah-Khan explains the market forces at work behind the cost for supplies and equipment.

Dentistry is a very fragmented industry in that practices experience different operational and economic forces. The larger a practice or practice group, the greater leverage they have with regard to negotiations. This is true in regard to reimbursement, supply cost, and equipment cost. This situation is leading to increased consolidation in the industry, which is apparent in the rapid growth of large “corporate” or “Wall Street” practices. The U.S. Census Bureau’s 2007 economic census found that the number of offices controlled by these large dental companies increased by 49% to 8,442. The number of corporate organizations, private equity groups, and similar organizations that have more than 10 offices increased from 157 in 1992 to 3,009 in 2007.

As we see increased consolidation of practice entities, we are also seeing consolidation of dental supply distributors. One of the large dental supply distributors stated in its 2013 10-K filing that consolidation within the industry will result in distributors with limited financial and marketing resources seeking to combine with larger companies. This consolidation will also lead to large companies being able to capitalize on this trend. 2 Lack of competition among suppliers and greater consolidation among practices is leading to a situation where the small, independent practices face increasing pressures to remain competitive. To remain viable, the small practices must develop systems to control costs and operate efficiently.

One simple aspect of cost control without changing operational practices is the ability to control supply costs. To control supply costs, a practitioner should understand the supply industry as a whole. The breadth of products utilized by a dental office, along with the fact that products are very user-specific, makes ordering all products from a single manufacturer not viable. As a result, manufacturers sell their product lines to dental distributors who will stock 40,000 SKUs of products and then sell and ship those products to individual dental offices. Because most individual dental practices do not have the ability to store supplies or the desire to purchase large quantities of supplies, they will place smaller orders with increased frequency.

When examining product costs, there is a wide range of price points for the same products. These price points can vary by Supply Company, region, practice type, and even by practitioner. Dr. Jones in Anytown, USA, can pay a different amount for a product than Dr. Smith in the same town pays, even if they are buying from the same distributor. Because solo practitioners do not have the buying power of a large group, they can pay a different amount across the board for their supplies.

Like all businesses, dental supply companies generate a profit based on margin. This basic economic concept is simply the metric between what the cost of an item is to procure vs. the cost of selling and delivering that item to the consumer. The margin on a dental item has a variety of factors. When ordering supplies, we tend to use a full-service distributor or a “mail order” distributor. In reality, the vast majority of dental orders, regardless of company, are placed in the same manner. All supply companies have online platforms where an ordering assistant enters the order, which is sent to the company for processing and fulfillment. Prior to the utilization of online platforms, orders were either physically placed with a supply representative who came into the office, or by phone or fax. While these are still methods of ordering, most offices embrace more technologically efficient methods.

It is easy to see that the more people involved in the ordering process, the more people who are compensated as a result of the order. Virtually all dental distributors have sales representatives who oversee each account and are compensated on sales by those accounts. Some companies utilize the traditional sales representative who physically calls on each office and facilitates order placement and supports that office. Other distributors utilize “tele-sales” representatives who facilitate order placement and support from a remote location.

Both of these types of service models are extremely important in the supply industry, as the diverse population of practitioners want different types of representatives. A field representative cannot support as many offices as a “tele-sales” representative due to time requirements. There are advantages and disadvantages to both of these sales/support models, and each practitioner must examine which model has the greatest benefit to their practice.

As in all businesses, companies have differing methods of compensating representatives, as well as differing pricing structures for products. The two main methods for dental representative compensation are a percentage of gross sales, or a calculation that includes the margin on the overall order. Company A may pay based on overall sales, which results in their representative being paid a flat percentage based on overall sales. Conversely, if company B pays on a metric, then the representative can receive a higher amount of compensation based on a greater margin realized on the sale.

Companies can also have pricing tiers where there is a margin level set for each tier. Offices are traditionally set in a tier based on their annual purchases. The greater the purchases, the higher the tier and the lower the cost. Another pricing model that occurs is formulary pricing. A formulary is an equation created where a merchant will price some items at a very low price, only to charge full retail for other items. This can be seen when a vendor matches or beats another vendor on a list of items, only to charge a higher amount on other items to make up the difference. With price matching, there are also instances where a vendor “matches” the price on specific items, only to slowly increase the cost of those items over time.

The final factor that practitioners should evaluate is the rise of the dental group purchasing organization (GPO). GPOs have been prevalent in medicine for some time. Technology improvements and electronic media have allowed them to rise in the dental space. GPOs typically band practitioners together and leverage their buying power to negotiate savings on products and supplies. The overall goal of a GPO is to allow all of the member practices to pay the same low rate on their supplies. GPOs attempt to “level the playing field” by putting all members on the same tier, regardless of size or volume. There are a variety of platforms for GPOs. These can be thought of in the same way as investment platforms. There are three major types of GPOs:

- Fee-based. The subscriber pays the organization an annual or monthly fee to have access to the group’s negotiated agreements. These fees typically range from $500 to several thousand dollars annually

- Percentage-based. These groups charge the subscriber anywhere from 5% to 20% on the total purchases per order. Many times these groups also have ordering and billing through their proprietary software

- No fee. This is a platform where the purchasing group does not charge the member any fees. The purchasing group is usually paid a percentage of total sales by the vendor.

Purchasing groups also vary in what is required of members. Some call for members to sign contracts and reach a certain spending level. Some require members to purchase for a certain period of time, while others call for no contract, spending minimums, or fees.

Like everything in dentistry, the supply industry is diverse. There are a variety of methods to achieve the goal of procuring dental supplies. One has to decide if supplies are simply a consumable commodity that should be purchased at the lowest cost, or if the practice needs the services of a company that charges a premium for supplies in exchange for other services that the representative may provide to the practice. There is also a middle ground where a practice can have aspects of both. Understanding factors that affect supply costs helps owners choose the best procurement scenario for their practice.

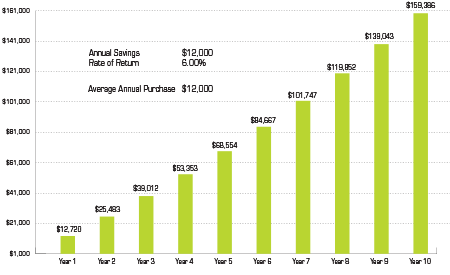

Each factor has a meaningful impact on overall cost of supplies and can result in cost savings for a practice. On average, a practice spends 6% to 7% of gross production on supplies. If you have a $1 million practice, 6% equals $60,000 in annual consumable purchases. By utilizing the most beneficial supply-saving methods mentioned here, a practice can save 17% to 20% on supplies. A 20% savings on $60,000 of supply expenses can result in $12,000 of annual savings. If practitioners can save and invest this amount annually, it can have a meaningful impact on their ability to cover costs, invest in technology, or even on their retirement date.

As practice owners, we have to be more than great clinicians to be successful. We must be the best CFOs of our small corporations. Being a great dental CFO involves a thorough understanding of the dental industry as a whole.